Insights

Beach Weather for Credit but Bring Your Umbrella (Loans)

Featured

All Articles ()

There are currently no articles for this filter

It's sunny skies and the summer start is marked by constructive tailwinds for credit markets. The improving fundamental picture is supported by robust albeit easing growth, falling inflation, the seeming end of peak rates and a still-resilient consumer and corporate earnings—the last of these is expected to further recover in the second half of the year.

Leveraged credit issuers have weathered this higher-rates regime much better than some might have expected just 12-24 months ago, with companies preserving margins in the passthrough of higher input costs to end-customers, as well as actively managing expenses. In fact, issuers have delivered positive EBITDA growth notwithstanding higher rates. All of this was helped by issuers entering the rising rates period from a starting position of relative strength.

Flash forward to present and things are getting easier, figuratively, and literally too (i.e., policy rates and debt service costs are expected to move modestly lower). Though a couple of rate cuts will help issuers on the margin, it will do little to dent the starting yield on the Morningstar LSTA U.S. Leveraged Loan Index, which entered June at 9.7%.

Though the soft landing probabilities appear heightened—it's now mainstream consensus—investors can be excused for shrugging their shoulders at capital market valuations. "Meh" is the tone of many client conversations. That's because today's all-time-high stock market and all-time-low credit spreads in many bond asset classes already reflect the positivity—much of the good news is "priced-in" as they say.

Meantime in this oft-overlooked credit asset class, we see a fat pitch in bank loans, and here's why:

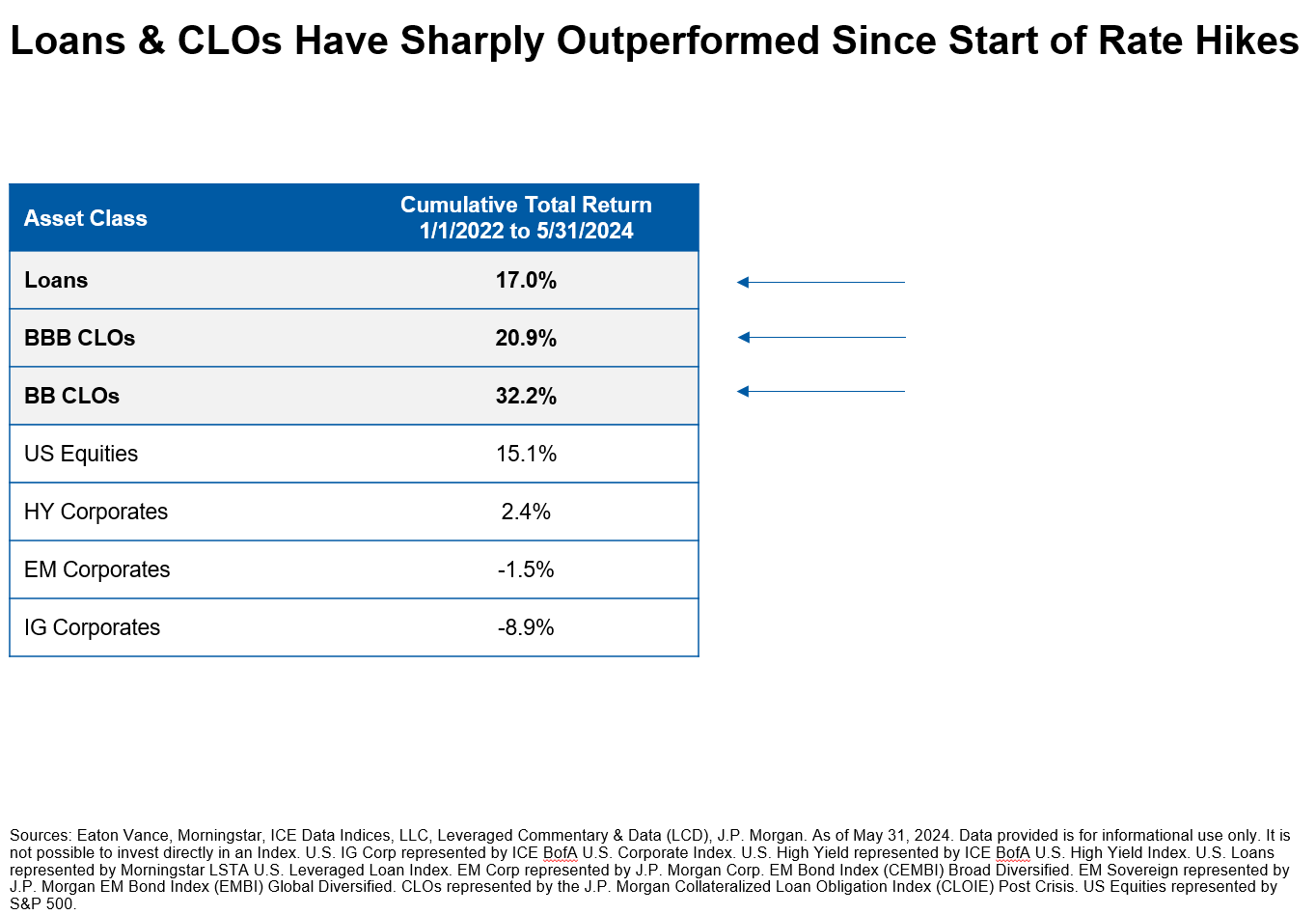

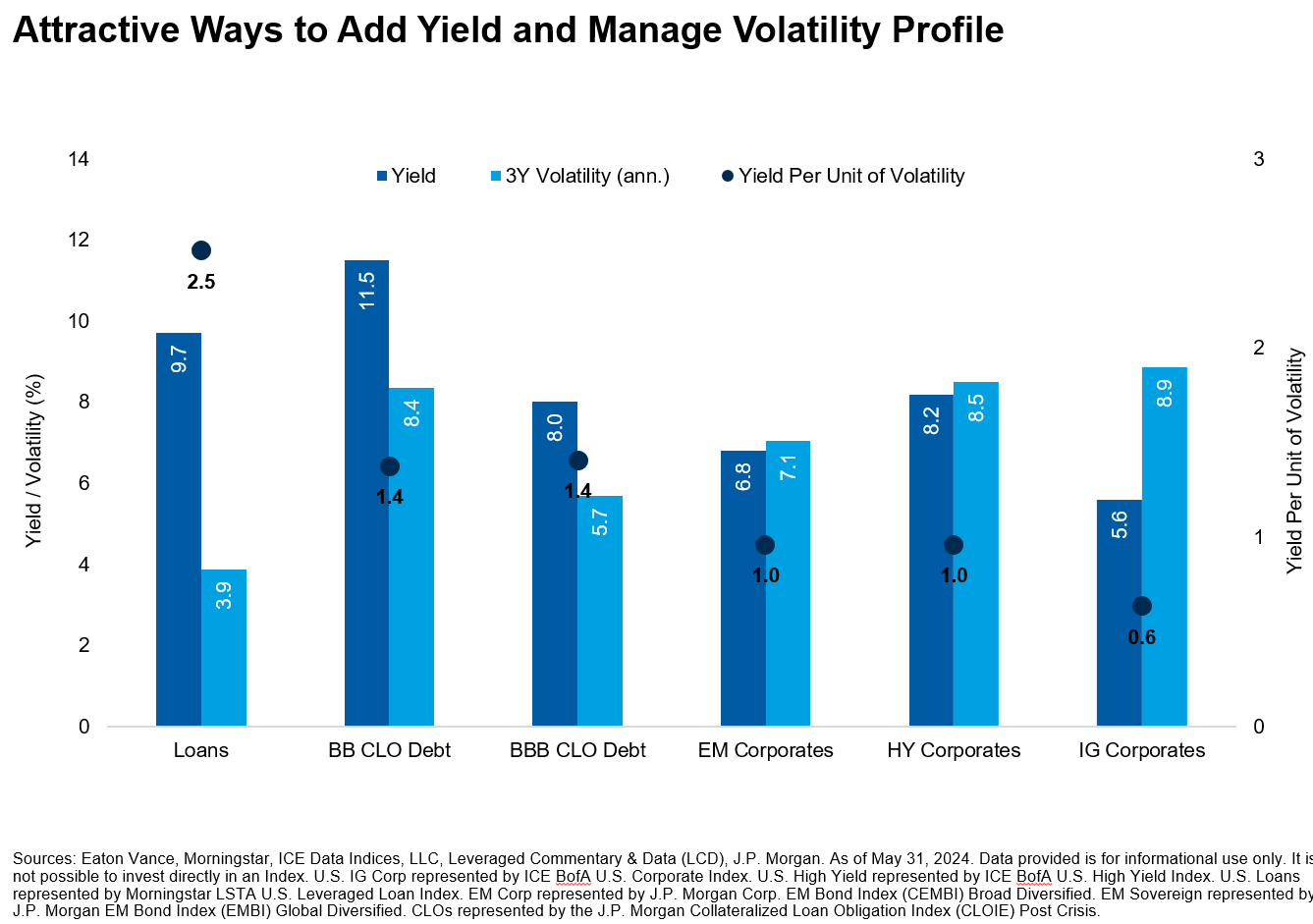

- High starting yields: The absolute yield in loans is one of the highest in fixed income, with levels not dissimilar to long-run equity returns, and CLOs (a securitized loan market cousin) offer even higher yielding (and higher rated) opportunities. Interest carry is a powerful phenomenon; it's what drives the majority of total return over time.

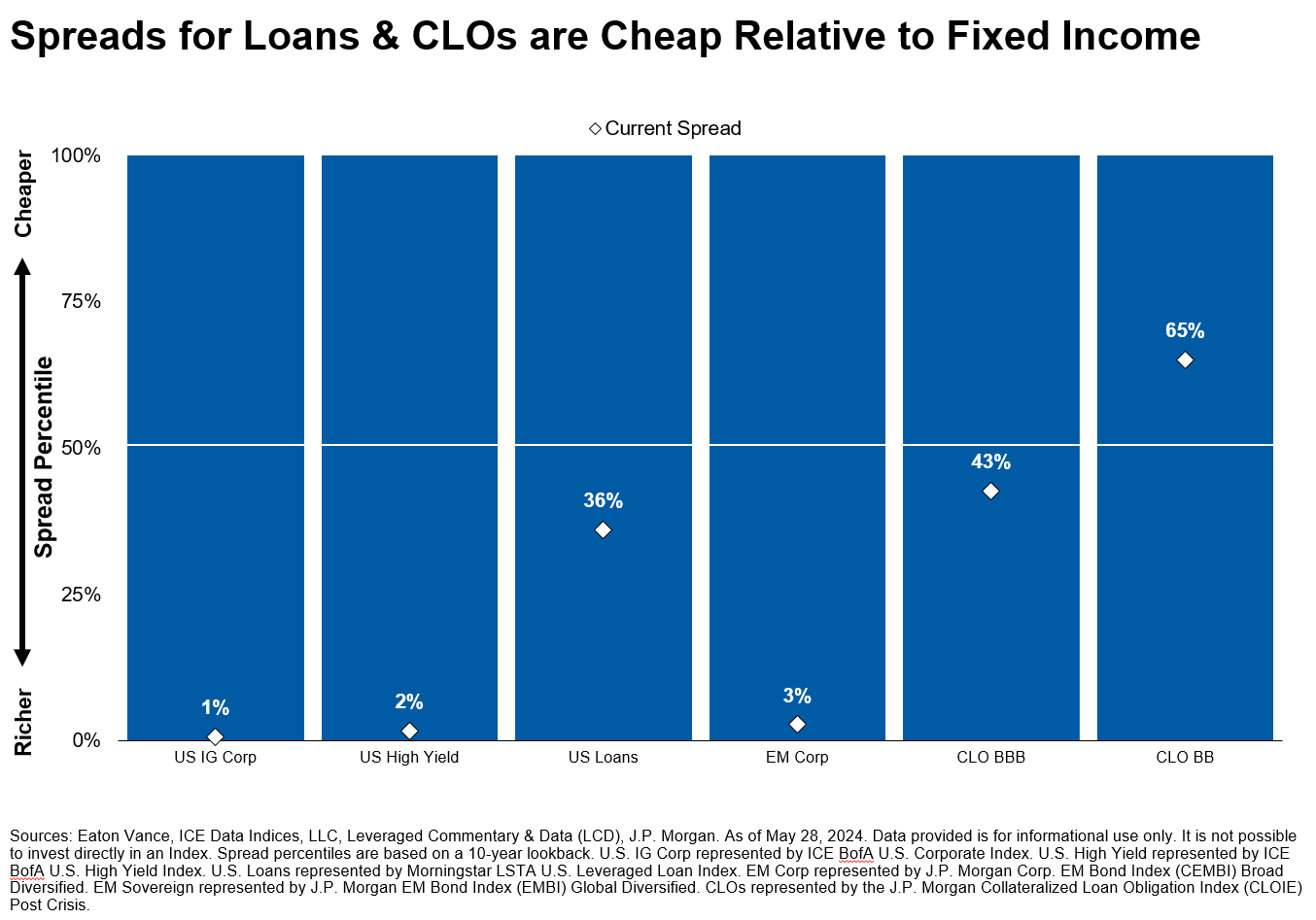

- Valuation opportunity: Despite the tightest decile spreads seemingly everywhere else in fixed income, spreads in loans and CLOs are just about average—this provides a form of cushion. When combined with a historically high base rate, distributable income from loans is at levels we haven't seen in over a decade.

- Supportive technicals: High yields are drawing investor inflows, and in particular the stickiness of the CLO engine is a stabilizer for the loan asset class. And on the supply side, high yields (and asset prices) are a governor on net new volumes. This is a supportive mix.

- Limited credit stress: We expect a continuation of the lower-but-longer default cycle with lower single-digit default rates into mid next year. Massive dry powder in private credit coffers provide a key (refinancing) buffer - this point is a differentiator compared with any period in past cycles.

Past performance is not a guarantee of future results

Taken together, we see loans and CLOs as one of the most attractive opportunities available to suitable investors. If the soft landing chorus is wrong, there is seemingly more downside risk in the overextended asset classes on both sides of the 60/40 equity and fixed income portfolio. The fact that loans are trading at much cheaper levels—with a high current income—is an insulating hedge.

And if the crowd is right about the favorable macro picture, that clears the path for credit investments—spanning high yield, loans and CLOs—with starting yields in these areas comparable to long-term equity market returns—yet with a par values, maturities and contractual income streams that by construction account for lower risk profiles.

Credit markets have historically delivered some of their best and more stable returns in environments in which credit conditions are neither running too hot, nor too cold—the so-called Goldilocks environment. That's because credit loves moderation, and the expectation ahead is for growth to moderate, inflation to moderate and policy rates to moderate.

No one can say for sure which way the yield curve will shift, however the beauty in loans and CLOs is that it's a hedge and works as one regardless of the curve picture that develops."

Bottom line: Loans and CLOs have yields that are twice that of core bond market proxies and about equal to long-term stock market results. Loans are anti-bond in structure (no duration, coupons float) and can complement portfolios across a spectrum of use cases: higher coupons than investment-grade bonds; larger and more liquid companies than present in private credit; trading cheap to the 60/40.

Though we see sunny skies for credit, loans can act as an umbrella for portfolios if rainy days arrive, yet won't hurt your day at the beach if they don't.