Insights

From T-Bill and Chill to Extend and Defend (your yield)

Featured

From T-Bill and Chill to Extend and Defend (your yield)

All Articles ()

There are currently no articles for this filter

Boston - "T-bill and chill," a popular strategy of rolling T-bills month after month, was many investors' best friend in 2022 and the first three quarters of 2023. Investors in this strategy missed the 13% drawdown in the Bloomberg U.S. Aggregate Bond Index in 2022, and they out-returned the index for much of 2023, at least until bond investors warmed up to the fact that the Fed was done hiking rates.

In fourth quarter of 2023, the bond market began one of its best stretches in decades, with the aggregate index returning nearly 7% and erasing its underperformance versus T-Bills in a matter of weeks. Since this recent run began, the index has more than doubled the returns of rolling T-Bills (10.5% vs 4.8%), and many active bond managers have posted returns far in excess of both over this same period.1

Money on the move

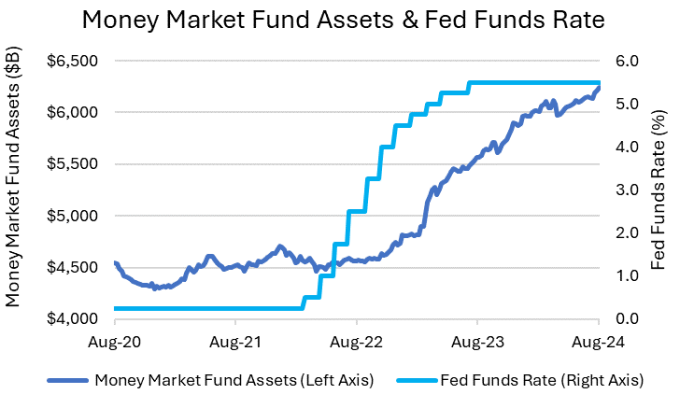

Like T-Bills, money market funds have been similarly popular in recent quarters. Since mid-2023, money market fund assets have grown by over $800 billion and nearly $2 trillion since the Fed began hiking rates in 2022.

Investors flock to money market funds

Source: Bloomberg. As of 8/28/24.

While some investors may be content just clipping yields that are well above pre-pandemic levels, as the Fed embarks on its cutting cycle, others will likely be looking to extend out the yield curve or risk spectrum to help preserve today's attractive yields. We expect "money on the move" to be a tailwind to bond investors everywhere, as cash looks for a new, "yieldier" home ahead of declines in money market yields.

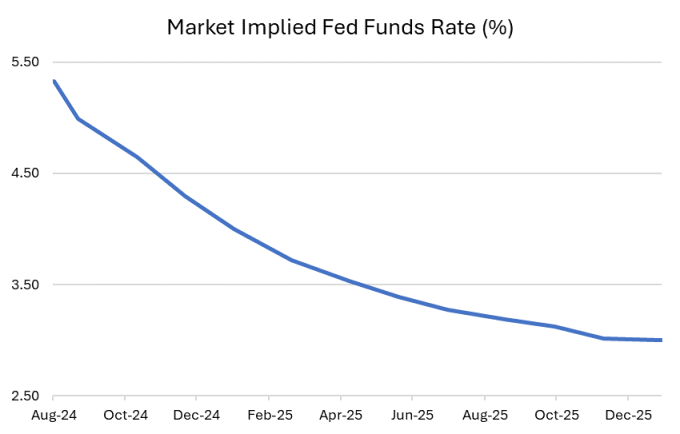

For investors inclined to continue just rolling T-Bills, you may be disappointed to find that you'll likely only be able to collect above 5% yields for another three months, according to market projections. Further, by March of 2025 those yields are expected to fall below 4%.

Peak rates to begin falling

Source: Bloomberg. As of 8/28/24.

Capitalize on today's yields in Agency MBS

So, what are investors waiting for? One common objection is the fact that the yield curve is still inverted. If you're currently collecting 5% at the very short end of the curve, why would you move out into something that's only yielding in the high-3% area? While that is true if you're planning to stay in U.S. Treasuries, there are plenty of other places that investors can seek to capture 5%-plus yields in the bond market.

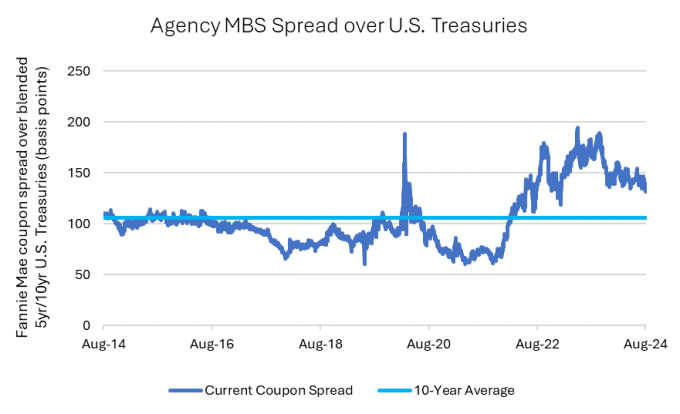

Contrary to what one might think, we believe investors don't necessarily need to take on a lot of credit risk to achieve that same 5% yield they're currently collecting in a T-Bill. One often-overlooked bond market, which is still trading at spreads well above historical averages, is the agency MBS market. The sector becomes even more compelling when considering that investors can preserve their 5%-plus yield for a longer period of time.

When rates are high, as is still the case now in the mortgage market, it is better to be a lender than a borrower, and the agency MBS market allows investors to do just that while also seeking to avoid credit risk. Further, with today's spreads sitting well-above their 10-year average, agency MBS investors can achieve yields in excess of 5% and the potential for capital appreciation if spreads were to compress towards their long-term average.

Agency MBS spreads remain compelling

Source: Bloomberg. As of 8/28/24. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

Bottom Line: A risk has entered into investor portfolios that they haven't had to worry about for years - reinvestment risk. Unless one believes the Fed is going to hike rates from here, the practice of "T-Bill and chill" will only lead to ever lower portfolio yields in the quarters ahead. Instead, investors who would prefer to preserve their yields above 5% while seeking to mitigate credit risk, can do so via the agency MBS market.

1 Bloomberg. As of 8/30/24.